BB Desk

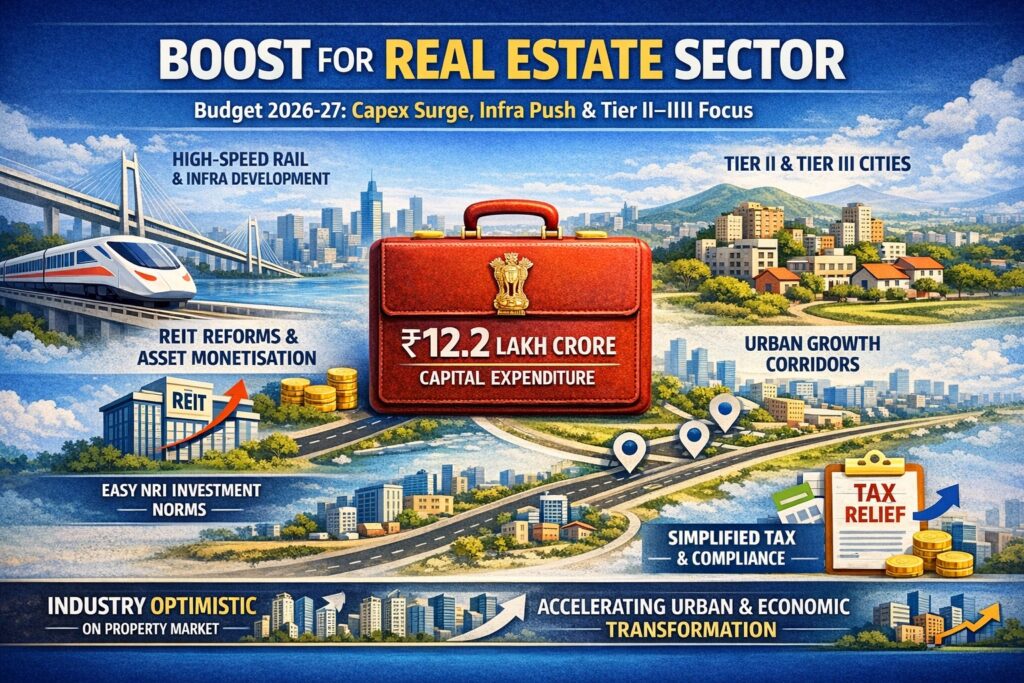

The Union Budget 2026–27 has received strong endorsement from leading voices in the real estate sector, who view it as a forward-looking, infrastructure-driven roadmap for sustainable urban expansion and long-term economic transformation. With higher capital expenditure, targeted development of Tier II and III cities, enhanced rail connectivity, REIT reforms, and investor-friendly tax measures, the budget is expected to unlock new real estate growth corridors, improve liquidity, and strengthen long-term investor confidence.

Infrastructure Push to Drive Housing Demand Beyond Metros

Hailing the budget as a strong foundation for inclusive urban growth and headlining the impact of capital investment, Prashant Sharma, President, NAREDCO Maharashtra says, “The significant increase in capital expenditure to ₹12.2 lakh crore, coupled with continued focus on Tier II and Tier III cities, will act as a powerful demand catalyst for real estate beyond metros. Improved connectivity, urban infrastructure funding and emphasis on growth corridors will significantly enhance housing demand and accelerate redevelopment, particularly in Maharashtra’s urban centres.”

Sharma also urged the state governments to align their policies to ensure faster project execution and improved housing supply pipeline.

Boost to Investor Confidence and Capital Access

Echoing similar optimism, Kaushal Agarwal, Chairman, Guardians Real Estate Advisory points out, “The budget sends a strong and reassuring signal to both homebuyers and investors by reinforcing economic stability, fiscal discipline, and long-term infrastructure planning. The government’s intent to strengthen the corporate bond market, encourage REITs, and streamline foreign investment norms will improve transparency and capital access for developers and investors alike. From a consumer standpoint, the emphasis on Tier II and III cities and the creation of City Economic Regions will unlock new housing opportunities and offer better value propositions.”

He further adds, “The simplified income tax framework and rationalised compliance mechanisms enhance ease of doing business, positioning Indian real estate as a more structured and attractive asset class for domestic as well as global investors.”

CPSE REITs Seen as Landmark Structural Reform

Calling the government’s move to monetise and recycle under-utilised land and real estate assets of CPSEs and public entities through dedicated REITs a landmark reform, Shilpin Tater, Managing Director, Superb Realty emphasizes, “This move signals a clear shift from traditional ownership to efficient asset management, allowing high-quality public assets to be professionally managed, listed, and unlocked for investment. Dedicated CPSE REITs will significantly deepen India’s REIT market by introducing a sizeable pool of institutional-grade assets, improving transparency, liquidity, and pricing efficiency across the real estate ecosystem.”

Drawing attention towards recent regulatory reforms, including SEBI’s reclassification of REITs as equity instruments Tater also highlights, ” These are expected to boost domestic and global institutional participation. As capital is recycled through market-led vehicles, dependence on bank financing for real estate projects will reduce, governance standards will improve, and long-term project financing will become more sustainable.”

De-risking Infrastructure and Strengthening Urban Competitiveness

Summing up the broader implications, Nihar J Thakkar, Founder, Mandate House Pvt. Ltd states “This budget reflects growing structural maturity in India’s development strategy. The proposed Infrastructure Risk Guarantee Fund is a timely intervention that will de-risk infrastructure execution for private developers and lenders, encouraging greater private participation. High-speed rail corridors will redefine inter-city business mobility and reshape commercial real estate dynamics across multiple economic clusters.”

“Taken together, these measures will enhance India’s competitiveness as a global investment destination while fostering a more integrated, efficient, and sustainable urban and commercial infrastructure framework.” concludes Thakkar.