In its most recent study on Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs), Knight Frank India emphasized how India is becoming one of Asia’s fast-growing infrastructure investment destinations. With InvITs leading the way in terms of scale, diversification, and growth prospects, the report ranked India as the fourth largest market for REITs and InvITs in the region.

Globally, there are over 1,000 publicly listed REITs and InvITs also termed as master business trusts, boasting a combined market capitalisation of approximately USD 3 trillion (tn). In India, there are currently five REITs and seventeen InvITs listed in the stock exchange, with a combined market capitalization of USD 33.2 bn.

The total Assets Under Management (AUM) of InvITs in India have reached approximately USD 73 billion in FY 2025. Driven by large-scale infrastructure investments, this figure is projected to grow 3.5 times to USD 257.9 billion (bn) by 2030. This surge will be propelled by higher allocations from institutional investors, increased participation of domestic pension and insurance funds, expanded foreign investment, and rising awareness among retail investors.

Elaborating on the study, Chairman and Managing Director of Knight Frank India, Shishir Baijal says, “India’s InvIT platform is at the threshold of a transformative growth phase. From an AUM base of USD 73 billion today, we are set to scale to USD 250–265 billion by 2030, marking a 3.5 times expansion in less than five years. This will not only bridge critical infrastructure financing gaps but also open new pathways for domestic and global capital to participate in India’s growth story. The challenge and opportunity lie in broadening participation — from pension and insurance funds to retail investors while maintaining the transparency and governance standards that have underpinned the sector’s credibility. InvITs have the potential to become the cornerstone of India’s infrastructure financing ecosystem and a magnet for global infrastructure capital.”

Investment Potential of InvITs in India’s Infrastructure Growth Story

Investments in India’s infrastructure have increased significantly in recent years, driven by the need to modernise assets and boost efficiency. The central and state governments have committed significant capital expenditure, with the centre taking the lead. Central government spending on the core infrastructure surged from USD 12 bn in FY 2015 to USD 75 bn in FY 2025, that’s a 6.2-fold rise, growing from 0.6% of GDP to 2.0% over the same period, reflecting a strong policy focus on infrastructure-led growth.

Infrastructure development will be crucial to achieving India’s USD 7 trillion economy target, which is estimated to require USD 2.2 trillion in investment. Meeting this demand will need substantial private sector participation alongside public funding. While greenfield projects carry higher risks, brownfield assets offer strong potential for private capital deployment. InvITs have emerged as an effective financing tool, directing institutional and retail funds into operational assets, enabling capital recycling and supporting timely infrastructure development.

To boost private participation, the government has introduced measures to channel capital into the sector. To clear Public Private Partnership (PPP) frameworks for greenfield projects, it has prioritised monetising brownfield assets to unlock value for new development. The National Monetisation Pipeline (NMP), launched in 2021 with a target of INR 6 trillion for FY 2021–25, achieved 95% of its goal. Building on this, NMP 2.0 announced in the FY 2025–26 Union Budget targets monetising INR 10 trillion worth of revenue-generating assets by 2030. These initiatives highlight the government’s commitment to attracting private investment, with InvITs positioned as a key platform for transparent, scalable, and long-term capital mobilisation.

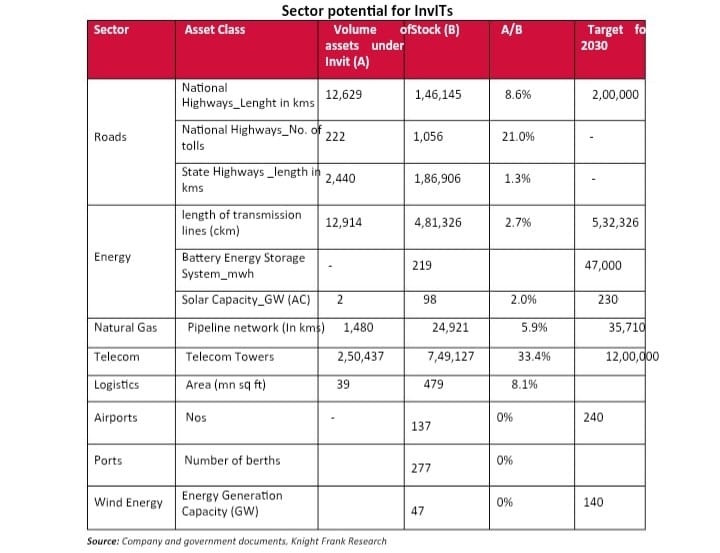

The potential for InvIT expansion in India remains significant across multiple infrastructure sectors. In roads, InvITs are the largest segment by value, comprising only 21% of operating NHAI toll assets, leaving ample scope for monetisation. In renewable energy, despite installed solar capacity exceeding 98 GW, InvITs manage just ~2%[1] of operational assets, with the government targeting 230 GW by 2030. In logistics, only ~39 mn sq ft of the 479 mn sq ft controlled by private operators is within InvIT structures.

Airports, ports, and wind energy are seeing greater private participation through PPPs and concessions, yet InvIT penetration is not yet visible. Stable revenue models remain a challenge, but measures such as risk-sharing mechanisms, credit enhancement facilities, Viability Gap Funding, long-term O&M agreements and predictable regulation can strengthen investor confidence.

Opportunities go beyond existing assets, with capacity expansions planned in roads, renewable energy, ports, airports, power transmission, and logistics driven by economic growth, urbanisation, and industrialisation. Supported by PPP policies and the INR 10 trn monetisation target under NMP 2.0 by 2030, this will create a sizeable, addressable market.